Argentina is in grave danger!

Stop the Vultures

Wall Street vulture funds and a confused Nixon-appointed NY district court judge are using vicious legal maneuvers to jeopardize the bond restructuring agreements Argentina made after its 2001 default for nothing but pure greed and profit.

The world’s top economists, the US State department and world leaders from all over the globe agree this move would imperil sovereign bailout agreements and endanger the global economy.

The Birth of

Vulture Funds

In 1995 defaulted Panamanian bonds were bought up by Elliot Mnt and tried in New York district courts breaking with the long-standing tradition of international law in which sovereign governments are not sued in district courts.

In the past countries in severe states of economic distress could negotiate agreements with the IMF and World Bank - much like businesses do during bankruptcy.

This opened the doorway for Wall Street tricksters with large amounts of capital, an army of attorneys, greed and no conscience to prey upon bankrupt nations like vultures. Forcing the impoverished nations to pay huge sums instead of facing economic recovery. Read more about Vultures Funds →

But WHO are the

Vulture?

They have a History of Dirty Tactics

And lots of money forLobby Power

How they Act

1. Vulture funds don’t exist to make money on investments. Their method is to make huge profits through extortion and interfering with bankrupt nations as they try to negotiate good terms on debts they cannot pay.

2. Paul Singer - with a total wealth of 1.5 Billion - is perhaps the best example of the advantages the 1% take from the system. He has poured millions to date into Republican super-PACs.

3. The vultures hold accounts off-shore and use US legal loopholes to pay next to nothing on their profits in the act of swindling.

Roadmap to

Argentina's Default

2005 & 2010 - Argentine debt restructuring

Argentina’s crisis in 2001 caused its financial system to collapse - leaving it bankrupt and unable to service its bonds. Between 2005 and 2010, Argentina's Government made arrangements with 92% of bond holders. Some of those who didn't accept the deal started litigation against the country.

2011 - Singer's Vulture Funds Buys Bonds on the Cheap and Sues on the High

Paul Singer's Elliot Management buys huge amounts of bonds cheap from “hold-outs” - bondholders who did not accept the offer of restructuring from Argentina. He then sues for the full amount of the bonds - 1300% the value he bought them for.

2012 - Judge Griesa rules in Elliot's favor

Judge Griesa rules in Elliott's favor - and "puts teeth" in decision - citing on a legal principle called “pari passu” - which requires New York banks who manage the bond payments to hold ransom payments - as “extortion” - to other bond holders who agreed to restructuring until the vultures are paid first.

June 2014 - SCOTUS refuses to hear the case

In June 2014, the Supreme Court of the United States refuses to hear the case. Because of this, Griesa’s sentence is confirmed and the clock starts to run out driving the nation towards default.

July 2014 - A Default is born

With no agreement to pay Vultures - NY banks don't pay other bond holders and Argentina is officially in default.

Even the US department of Justice recognized that adopting the legal theories the Vultures are proposing in the case would imperil sovereign bailout agreements worldwide, negatively impact the global economy, and open the door for a new era of predatory vulture investment.

Judge Thomas Poole

Griesa

is a federal judge for the United States District Court for the Southern District of New York.

83 Years Old.

Appointed by Nixon, so do the math...

Insanely Right Wing.

Seriously, insanely right wing.

Often CONFUSED and TURNING IN CIRCLES throughout case.

How Bad is this in the end?

Bad!

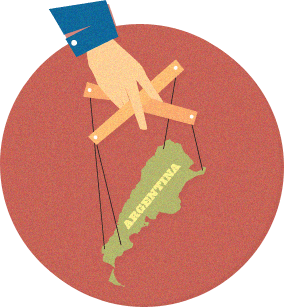

ONE MAN

holds the power of determination of fate of country. How can that be fair?

NO CREDIT

Not only would the payout be huge, but failure to pay others impacts Argentina's credit.

RUINS

the fair agreements with other bondholders, while making future bailout negotiations more difficult.

ARGENTINA

continues to not have the ability to return to normal economic standing which will result in many more years of suffering.

There is a

Solution

We, the Undersigned

- Support the right of Argentina and other poor nations in their fight against vulture funds.

- Call on the UN to enact international conventions to prevent speculative attacks by vulture funds.

- Call on the US Congress and the European Parliament to enact anti-vulture legislation.

*please note, we may share your information but will only do so with the organizations listed below and only to engage in urgent actions related to the fight against vulture fund activity. We need everyone’s voice to make this movement succeed.